__________________________________________________

__________________________________________________

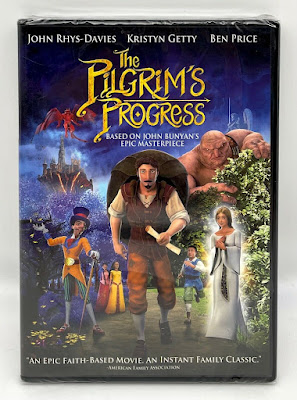

This image does not make any selections. To make a selection you have to read the options below the image instead and make a selection from them. Be advised the price varies depending on which company is selling this!

__________________________________________________

__________________________________________________

Promote Accessories as a way to make

Affiliate Commissions.

Mobile App

Earn up to 25% commission for every successful referral

Recruit partners to earn up to 20% commission on partners' referrals/purchases

__________________________________________________

__________________________________________________

__________________________________________________

__________________________________________________

__________________________________________________

__________________________________________________

Learn about the best nootropics, available from Bright Brain.

__________________________________________________

__________________________________________________

Cram is a nootropic supplement for those who need maximum enhanced mental performance, focus, concentration, and memory in concise time frames such as exams, presentations, labs or any situation in which extreme mental performance is needed for a short-term period.

_________________________________________________________

__________________________________________________

Absolute Focus Is The #1 Nootropic Supplement For mental performance, learning, focus, alertness, cognitive improvement, logical reasoning, memory recall, overall energy and more.

__________________________________________________________________________

Triton PokerLLC________________________________

__________________________________________________

__________________________________________________

__________________________________________________

__________________________________________________

Buy Ready Refresh

_____________________________________________________________________

_________________________________________________________________

Levi's MEN'S CLOTHING ON SALE

___________________________________________________________________________________________________________

In Surprised by Hope: Rethinking Heaven, the Resurrection, and the Mission of the Church, top-selling author and Anglican bishop, N.T. Wright tackles the biblical question of what happens after we die and shows how most Christians get it wrong. We do not “go to” heaven; we are resurrected and heaven comes down to earth--a difference that makes all of the difference to how we live on earth. Following N.T. Wright’s resonant exploration of a life of faith in Simply Christian, the award-winning author whom Newsweek calls “the world’s leading New Testament scholar” takes on one of life’s most controversial topics, a matter of life, death, spirituality, and survival for everyone living in the world today.

___________________________________________________________________________________________________________________

| I saw it on Fastbuy Inc

Buy Cheap Ukulele, Glarry Best Ukuleles for Sale - Glarry

|

Survey Junkie

(continental U.S., excludes digital products)

________________________________________________________________________________________

________________________________________________________________________________________

Whistleblower link

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

1948 ________________________________________________________________________________________________________________________________________________________________________________

More 1948________________________________________________________________________________________________________________________________________________________________________________

Affiliate marketer links:

1 Oh clap your hands, all ye peoples; Shout unto God with the voice of triumph.

2 For Jehovah Most High is terrible; He is a great King over all the earth.

3 He subdueth peoples under us, And nations under our feet.

4 He chooseth our inheritance for us, The glory of Jacob whom he loved. Selah

Biblical & Prophetic Music!

The Official Channel for Lamb & Joel Chernoff

Pioneer / Popularizer of the Messianic Jewish Music Genre. Shalom friends!

Throughout the years, the pioneering lyrics and sound of LAMB have provided countless hours of joyful praise and meaningful worship for followers of Yeshua around the world. Many of LAMB's classic songs have become anthems of faith in the Messianic community that are sung in congregations and homes and wherever else believers in Yeshua gather together to praise and worship their Messiah!

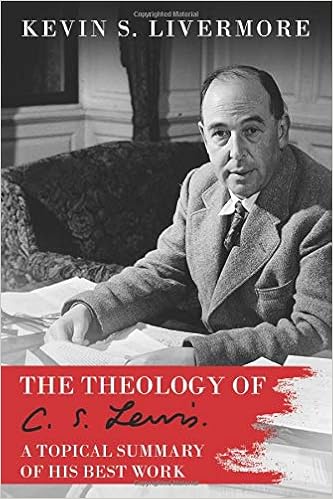

Despite his status as one of the most influential and intelligent Christian authors of the 20th century, C.S. Lewis never thought of himself as a professional theologian. While he was well-read in many types of literary genres, he did not go to Seminary to obtain a Masters in Theology and study a year of Old Testament Hebrew and New Testament Greek. He was not a Pastor who preached sermons to a congregation for many years but a raw, honest philosopher and professor of literature who wrote as well as any Christian of his time could. He had a gift for clearly articulating his perspectives on a variety of issues. Above all, he was humble, in that he had an honest evaluation of both his strengths and his weaknesses. I believe this is one of the main reasons why he is still so enjoyable to read even after all these years. In terms of his theology, Lewis himself said he was an “Anglican but not especially ‘high,’ nor especially ‘low,’ nor especially anything else.” So the theology of C.S. Lewis is not something one can immediately discover by simply perusing a certain book of his to see exactly where he stands on certain doctrinal issues; it is much more subtle and convoluted than that. But in this book, you will find his different thoughts from his many books about certain Christian doctrines and topics pieced together in an easy-to-follow format (Lewis has written nearly 60 books but none of them are on systematic theology). This book offers very clear depictions of his theology concerning subjects such as the doctrine of inspiration, original sin, human depravity, human origins, evolution, intelligent design, theodicy, love and marriage, redemption, grace, new creation, and grief, as his authentic reaction to God after his wife’s death is conveyed. The final chapters also contain all of his greatest quotes arranged and sorted by topic as well as excerpts, quotes, and summaries from most of his books in a quick, easy-to-read, bullet-point format. These last two sections are a particularly great resource to draw from as you can quickly learn about the main points Lewis conveys in his bestselling books.

________________________________________________________________________________________

________________________________________________________________________________________

___________________________________________________

| I saw it on ChefsTemp

Best Steak Thermometer 2021: ThePocket Pro

|

_____________________________________

Shop anywhere. Snap every receipt. Earn FREE gift cards! �� Sign up for Fetch with my code "MCWDK" and get 2,000 points when you snap your first receipt #ShareFetchRewards

https://fetchrewards.onelink.me/vvv3/referraltext?code=MCWDK

No comments:

Post a Comment